Effective Inventory Management – Article 1 – SKU Categorisation

"Cash is King!"

It is a well-known fact that more businesses go bust due to lack of cash than through being unprofitable.

Within the Current Assets section of your Balance Sheet, stock is your least liquid asset, for example what if you have 6 months stock of an item and a customer paying on 90 days credit terms. In this scenario, if your stock even sells, it will be at least 9 months before the stock turns to cash. If it doesn’t sell, it’s like having your cash sat on a shelf, earning nothing and diminishing in quality and value over time.

Your cash is Blowing in the Wind!

Effective Inventory Management and the management of cashflow are critical to success in the modern day organisation. So what can we do in Procurement and Supply Chain to effect this? Surely Finance manages cashflow?

Our input is critical to success. In this article, we are going to focus on the categorisation of Stock Keeping Units (SKU’s), which is the basis for all Inventory Management activity.

Categorise / Stratify your SKU’s

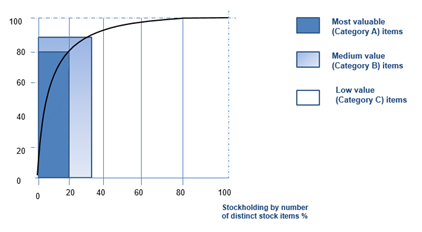

A SKU is a Stock Keeping Unit,(SKU), an item or part that you sell. SKU’s should be categorised by their key attributes, which are Usage and Value. Multiply all SKU’s out by Usage X Unit Price, (Value) and sort the resultant SKU’s in descending usage / value order.

From here Pareto would suggest that the 80:20 rule would apply, 20% of your SKU’s by usage / value will represent 80% of your spend, focus on these and you will be fine.

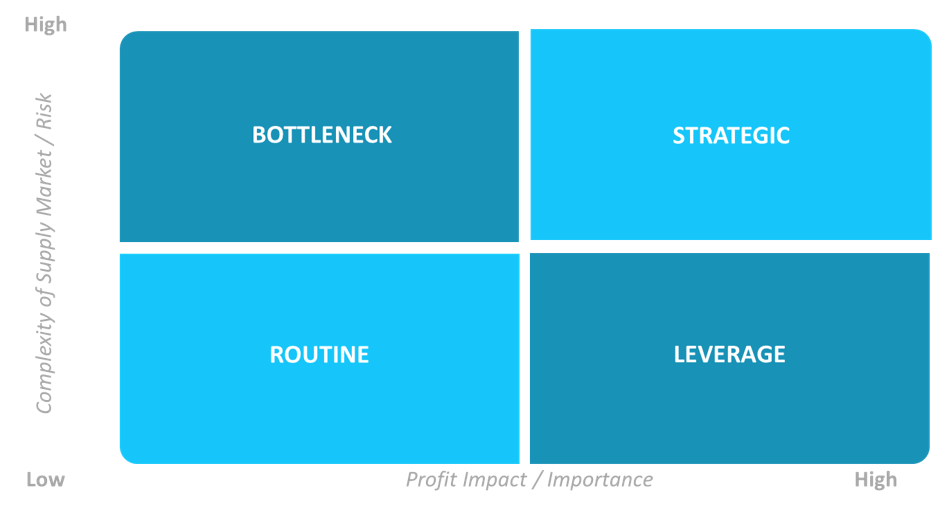

Principally Pareto is correct, although the model is one-dimensional, considering spend/value only. It does not consider the risk of the one SKU of low value and low usage that is on every vehicle and could potentially stop an automotive production line. Pareto would consider this to be a ‘C’ line.

To fix this along came the Kraljic Matrix, a two-dimensional model, which considers Spend/Value and Risk. These Bottleneck ‘C’ items need to be treated the same as the Pareto 80:20 lines.

In principle, Pareto is correct: the top 20% of SKU’s, covering 80% of usage/value must be your ‘A’ lines. These products require major focus and daily attention. If these SKU’s are always in stock, your service level will be very high. The high risk item of low value and low usage, with one on every vehicle, should also be promoted to and managed as an ‘A’ line. A good inventory management team will aim to ensure that all A SKU’s are constantly in stock, through daily focus.

Next are ‘B’ SKU’s, which will probably make up the next 10% of your spend and 10% of items by usage/value and risk. These are also important to service level success, but not as much as ‘A’ lines. Finally come the ‘C’ lines, ‘The Trivial Many.’ These products generally account for 20% of the SKU’s by usage / value and 70% of the actual SKU’s by number. These products require much less management and will have a negligible effect on service level if you run out of stock and can not fulfil a customer order.

This is the theory however in reality it is not quite so simple. In my experience, in one organisation I was responsible for 20,000 SKU’s and a stock management team of 12 people. In our SKU categorisation we had AAA, AA and A categorised SKU’s. The AAA’s represented the Top 500 SKU’s by usage value of the 20,000, 2.5% of the SKU’s.

Service Level explained simply – If a customer orders 10 items and we have 9 in stock, this represents a 90% service level.

In this case the reality was that if we had the 500 AAA lines in stock, we would always be around the 95% service level mark or above. However, if as few as 3-5 of the AAA lines were out of stock, then the service level would dip to the low 90%’s. This is the significance of SKU categorisation and the tight, daily management of AAA lines.

Against the 500 AAA SKU’s, good practice would be to have an alternative UK provider against all 500 AAA categorised products, to call on in an emergency, or to make the primary provider, where consistent issues arose.

Aged Stock

In reality, no organisation will have just A, B and C lines, most will have many other categories of stock, including ones specifically relating to ageing stock, over 3 months, 6 months, 12 months and beyond.

Aged stock is a huge contributor to cash problems, it may look like an asset on the Balance Sheet but the reality could be something different. As the stock ages, there is more chance of it becoming obsolete, damaged, beyond shelf life, all ultimately leading to costly write-offs.

This and many other areas relating to Procurement and Supply Chain’s contribution to stock management will be covered in the next article.

This article was written by Gary Tinsley FCIPS, BA (Hons), DTLLS, Co Founder of SR Strategic Sourcing Ltd.

For further details and information on Managing your Supplier base and how this can help your organisation please contact us or click through to the following pages

Introduction to Category Management

Adding Value though Effective Contract Management in the Public Sector